Who else gets stressed out just thinking about money? Between remembering to pay bills, sticking to a grocery budget, and trying to blow through your monthly savings, personal finances can be overwhelming.

The temptation to make impulse buys is always strong, too—especially in stores filled with deals that mention our names.

But what if managing your money could be easier? What if, with just a few clicks, you could get a bird's eye view of where your money is going and what changes you need to make to avoid losing it and ultimately achieve your savings goals? Well, budgeting apps make financial clarity a reality.

These intelligent digital tools connect to your account and track every cup of coffee, online order and tip. They then analyze your spending data and provide insights so you can take control of your money (before it takes control of you).

We're intrigued by the idea of money habits that make it easy to control your spending and reduce stress. Yes, so do we. We'll cover five key benefits of adopting a personal financial planning app.

5 Benefits of Using a Budgeting App for Personal Finance

Adopting a budgeting app can help reduce money stress and put you back in control of your finances. Let's explore the main benefits these tools bring to users:

1. Automatic savings

Interest earned on automatic savings deposits adds up faster than expected! Budgeting apps allow you to set up recurring transfers from your checking account to a separate savings or investment account. This removes the pressure to save as much money as possible each month. Build long-term wealth without any action on your part.

2. Understand consumption habits

Budgeting apps can show you where your money goes each month by syncing with bank/credit accounts and categorizing every dollar spent, often leading to shocking revelations! Most users have many unnecessary expenses. This valuable visibility enables conscious reduction and conservation strategies.

3. Convenient invoice management

Keeping track of bills between your mortgage, utilities, insurance payments, and recurring subscriptions is easy. The budgeting app collects all due dates in one place and sends notifications when each bill needs to be paid. This invoice tracking view reduces late fees and the hassle of last-minute payments.

4. Motivation to achieve goals

With foresight, finding the motivation to save for a big purchase or pay down debt can be challenging. Budgeting apps let you set financial goals, such as a dream car or an exotic vacation. As you stick to your spending limit, the progress bar gets more extensive, and the target date gets closer. This increases enthusiasm and engagement.

5. Convenient 24/7 access

Do you want to spend the night in the town? Before you head to the ATM, open a budgeting app to see your checking account balance down to the second. Are you planning to make a spontaneous purchase? Start by checking for a room in the "Clothing/Shopping" category. Bill payment due dates, goal progress, and cash flow are all provided in an easy-to-use format.

Diploma

Personal financial budgeting apps use automation, insights, organization, and accessibility to help people manage their money quickly.

Instead of continuing to struggle with financial struggles month after month, use a budgeting app as your financial companion to take control of everything.

Frequently Asked Questions

Q: Which budgeting app is best for managing personal finances?

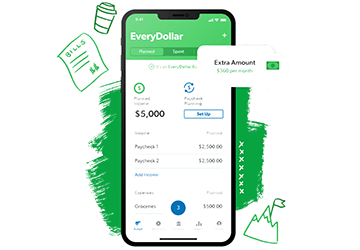

Answer. Popular options like Mint, You Need a Budget (YNAB), EveryDollar, and PocketGuard all come with unique features. Try a free trial to determine which app method best suits your style and financial goals. Ease of use is critical.

Q: How do I select a budget category in the Personal Budget app?

Answer. Evaluate your past bank and credit card statements to identify key spending areas, then create categories for housing, transportation, groceries, personal care/entertainment, debt payments, and more. Adjust the categories later as needed - put more minor expenses into the "Other" category.

Q: What happens if I spend less on a budgeting app?

Answer. First of all, don't panic and don't feel guilty! There will be additional charges. Budgeting apps make it easy to see how much you're over budget and by how much. Review transactions for overspending, then decide what to cut in the next budget cycle to offset the overspending.