With global inflation, keeping track of your money and how you're going to spend it over the course of a month has become crucial. Having a budget is important if you want to keep track of your money. It's a great way to save money and keep track of your money and where it goes.

Creating a budget is complicated and can seem overwhelming to someone who has never done one. But now you don't have to worry because we have the perfect solution. This article is an in-depth guide to help you create the ideal budget.

How do you create the perfect budget?

Nervous when working on a budget? There is no reason to worry. The steps listed below are simple. So grab your pen or computer and start budgeting with us.

1. Calculation of gross income:

The first step to creating the perfect budget is to calculate your net budget. This step is crucial because only then will you be able to budget around your net income. If you calculate your net income, everything must be entered here. Subtract taxes and other deductions so you have a reasonable amount.

You may be wondering why taxes and other such sums are withheld. Adding these things creates the illusion that you have more money, which can lead to overspending. Therefore, it is recommended to remove such items and enter your net income instead.

2. Tracking Fees:

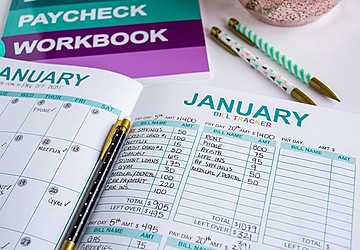

If you have any idea of how much money you have in total, you need to figure out where it is going. The best way to do this is to create categories for the things you spend money on. By presenting everything visually, you can clearly see where you are spending your money, making the whole tracking process easier.

Now it's time to classify your expenses. You can split categories into bills and rent, and even add car payments. The next category changes monthly and can be groceries, entertainment, subscriptions, and travel expenses. Also, day-to-day expenses vary. So be sure to keep track.

3. Fixed and variable fees:

Once you have listed all your expenses, the next step is to label things. There are two types of costs. The flat fee doesn't change from month to month and you have to pay it anyway. This is where you mention rent, monthly bills, insurance payments, debt payments, etc. In any case, these are some of the costs that you will have to pay each month.

Variable expenses refer to monthly entertainment subscriptions, gym memberships, etc. If you're strapped for cash and need to save some money, these expenses can be avoided.

4. Track your spending:

Once you've listed your fixed and variable expenses, the next thing to do is keep track of your expenses. Tracking costs isn't that difficult. Fixed prices are usually the same every month, which means your work is cut in half.

Every little thing you spend money on, whether it's gas or paying rent. Track all of these and deduct from your earnings. Also, make sure to keep track of your bank transactions as this will help you understand where your money is going. This way you can see where you are spending your money and how to avoid overspending.

5. Set financial goals:

The lengthy process of budgeting and executing is all about saving money for the future. So, before planning your budget, you need to set goals. Set long-term and short-term goals. Short-term goals typically last three years, while long-term goals are things like retirement planning.

These goals will motivate you to stick to your established budget and allow you to save money for the future. That's why you need to set goals when creating a budget.

6. Make a plan:

Now comes the hard part: you need to make a plan. Track expenses and how you spend them, variable and fixed costs, and start planning. It's important to focus on priorities. First you need to focus on fixed costs, then you need to focus on variable costs.

You can also allocate a budget according to your needs and desires. First, make sure all your needs are met, then you can spend a certain amount of money on your desires and luxuries. It's the perfect way to get your needs met before heading out to eat, shop, etc.

7. Make adjustments:

Once you have a plan in place, you need to adjust your lifestyle and past spending. This prevents you from overspending and allows you to save money to achieve your short- and long-term goals. Sometimes the adjustments can seem big, like going out less or shopping less. This might be an inconvenience at first, but once you start adjusting to this new way of life, you'll find it's easy.

Diploma:

Unknown to many, having a budget is very important, especially given the current state of the world. You have to understand that budgeting and saving money is very good for the future. So, we hope this article helps you create the right budget.